Japan ETF Review

With Japanese stock markets hitting levels not seen since early 2009 it may be a good time to take a look at Japan ETFs to see if there are any bargains. Being the 3rd largest economic power in the world, Japan is a large force in the world economy. Since peaking in 1989 the large cap Nikkei along with the Japanese economy has struggled in a prolonged bear market.

This has lead to relatively inexpensive stocks especially if one looks at the Topix which is mostly small cap stocks.

According to Dr Steve Sjuggerud:

“Small-cap Japanese stocks are trading at just 0.7 times book value – or a 30% discount to book value – and 0.34 times sales. This is off-the-charts cheap. Those are the statistics of the WisdomTree Japan Small Cap Dividend Fund (DFJ).”

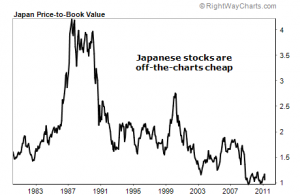

Here is an accompanying chart that shows how price to book value has contracted over the past 20+ years.

When you look at that chart and consider that things have gotten dramatically cheaper in the past few days it should seem obvious that there is some long term potential here.

The Japan ETF that was mentioned by Steve was the WisdomTree Japan SmallCap Dividend (DFJ) but there are several to choose from.

DXJ – WisdomTree Japan Total Dividend Fund (Large Cap Value)

EWJ – iShares MSCI Japan Index Fund (Large Cap Blend)

ITF – iShares S&P/TOPIX 150 Index Fund (Large Cap Blend)

SCJ – iShares MSCI Japan Small Cap Index (Small Cap Blend)

JSC – SPDR Russell/Nomura Small Cap Japan Fund (Small Cap Blend)

Leveraged Japan ETFs:

EZJ – ProShares Ultra MSCI Japan ETF (2X Long)

EWV – ProShares UltraShort MSCI Japan ETF (2X Short)

Use caution and make sure you understand the risks before investing in any ETF. This is especially true if you decide to try a leveraged ETF.