The Only Stock Indicator That Matters!

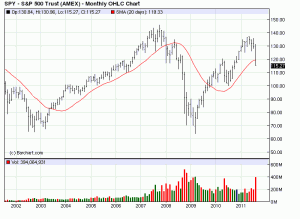

The whole stock market changed last Thursday when the S&P 500 plunged through the 20 month moving average in the closing hour of trading. I had used the summer lows as stops on my positions so I basically got stopped out of almost everything that day. It made me sick to think that I might be getting stopped out at the bottom but now I’m relieved I followed my “Rules”. That’s the thing about stops, they force you to use discipline instead of running on emotion.

Since we are going into the 4th year of a presidential cycle I’m still bullish on stocks, but as long as we are trading below the 20 month simple moving average I can’t be long stocks. The number for the S&P 500 ETF (SPY) is 119.33, so basically if we close the month of August below that number it’s a major warning sign for the market. Look what has happened in the past when we couldn’t get back above it ( Jan 2001 and July 2008) both failures preceded devastating 50% declines.

If we get back above 1200 on a closing basis it could lead to a huge short covering rally, so it’s the only number you need to watch.

Nibbling On Volatility

This morning I couldn’t help buying a couple things however. Gold is up another $50+ to new all time highs and the gold mining shares are mostly down, so I bought the gold mining ETF thinking it’s probably about the safest stocks around. Additionally I purchased the Inverse Volatility ETF (XIV) as the VIX spiked to 40 in early trading. Unless we are going into an all out 1987 or 2008 style crash volatility could easily peak in this area. XIV is designed to rally when volatility decreases and in my opinion is one of the surest bets when things get crazy. I never liked shorting volatility using futures because you can get hurt extremely bad in the short run (VIX spiked over 90 in 2008) but using an ETF you have a predefined risk. Even if the stock market loses 90% of it’s value volatility will eventually come back down to below 20 once it’s done trashing around. Additionally, volatility normally comes down long before stocks begin rising.

You can see it better looking at a 12 month chart from 8/4/2008 through 8/4/2009. Notice that the VIX peaked (near 90) in October 2008 but the S&P 500 didn’t bottom out until the beginning of March 2009. By the time the S&P 500 actually bottomed out the VIX had already fallen by nearly 50%.

This means that you can actually make money twice on a huge stock market decline. You can short volatility when panic is at it’s peak and then you can take some profits and use them to buy cheap stock when the averages finally grind out a bottom.