Investing In Metals Can Be Treacherous!

I have always loved trading precious metals because they are very technically oriented (especially silver) and you can often find patterns that consistently work. However, there are times when they become so volatile that it’s best just to get out of the way. This year we have had several examples of that type of volatility.

Silver went parabolic in March blasting to it’s all time high at nearly $50. At the time I heard of several people putting up to 50% of their retirement accounts into the silver etf (SLV). I felt sorry for them when the market turned and plunged to $30 giving back almost all of the gain in a matter of days. The entire “giveback” was completed recently in the massive “Risk Off” liquidation sending silver futures back to their January low of $26.

Next it was gold’s turn to go parabolic (in July) blasting to new all time highs, making a double top and giving then retracing most of it in a few days. Gold is still up significantly on the year but I’m not so sure we are completely out of the woods yet.

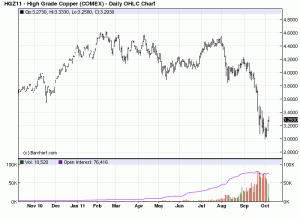

The biggest loser so far in 2011 has been copper & especially copper stocks. In fact, if you look at the following chart of copper futures you can see that it’s down nearly 25% since the beginning of the year. Copper prices are the most economically sensitive of the 3 so it makes sense that it’s had a tough year. If we actually slide into another recession there is probably another 25% downside in copper.

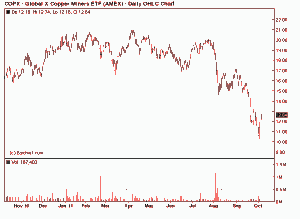

If you look at the daily chart of the most popular copper etf (COPX) which is made up of copper stocks you can see the carnage is even more severe. COPX was down nearly 50% for the year before the reversal on Monday.

We are in an environment where the short term pressures are deflation and recession but everyone expects monetary lead inflation in the long term. This leads to a very volatile environment. This is why it’s best to limit metals to about 10% of your overall investment portfolio, otherwise volatility can keep you up at night!