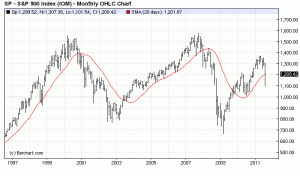

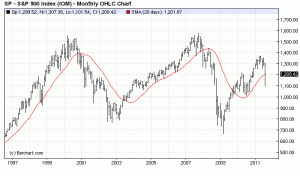

Most stock market participants may be thinking the worst is over for stocks, others think we are on the verge of another 2008 collapse. This is one of those times when there is a tremendous amount of uncertainty. In fact, other than 2008 and 1987 uncertainty is as high as it’s ever been. A few weeks ago I told you about the only stock market indicator that matters which is the 20 month simple moving average. This is a very simple indicator, if the S&P 500 index closes the month above the line we remain in a bull market. However, if the average closes below the line we are almost certainly entering another bear market similar to 2008-2009.

In order to avoid that, we will want to see the S&P 500 ETF close above $119.62 and the S&P 500 cash index above 1202. As I write this the S&P 500 cash index is trading at 1208 after climbing back above the moving average during yesterday’s huge rally. It is possible for this indicator to give a false signal but that doesn’t happen very often. As you can see in the chart above the severe Asian crisis related sell off in October 1998 closed right on the average and it continued to jab it in the weeks ahead before going back to new highs. This is what I’m hoping will happen in this case. You can see that last year the market was testing the 20 month average at the time Bernanke announced QE2. The successful test was the best buying opportunity of the year.

However when you look back at 2000 you can see that after breaking below the line in October 2000 it managed to close well above it. Then in November it took out the October lows before rallying back up to the line and failing. Again in January the highs were just below the line and that was the final tipping point.

If we close out the month of August above the line, I would like to see a retest of the line in September and have it hold. If it drops back below it next month that would be a sign of ongoing weakness. The market got fairly washed out in the first half of August so there really shouldn’t need to be more weakness unless there really is an underlying problem such as a double dip recession. That is what is ultimately going to play out if we do go into a second bear market move. The market normally leads the economy by 6 months, so if the market breaks down from here so will the economy.

I am currently long stocks and especially bullish on the Nadaq and the oil etf (XLE) as the energy stocks were literally pounded during this market decline. However, if we go back below 1200 I will be out of stocks. I would rather miss out on a rally than sit through a beating like the one we saw in 2008-2009. In fact, I’ll probably check out the short etf list and see if there are a few candidates to catch the downside.

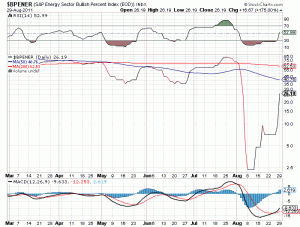

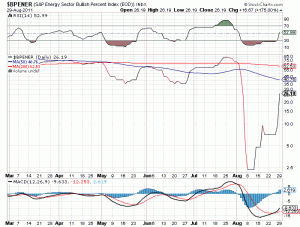

However until the market fails you can see by the chart below that the Bullish Percentage for oil stocks recently reached 2 and is just coming off the bottom. This is why I’m bullish on energy stocks unless the bottom falls out of the S&P 500.